Finding out the amount of military pensions is important for service members and their families, as it directly impacts their financial security and planning for the future. This knowledge helps in making informed decisions about retirement, and benefits, and ensuring long-term stability.

Key Takeaway:

- You can receive a pension of up to 48.5% of your final pensionable earnings, alongside a tax-free lump sum equal to three times your annual pension.

- Use official calculators and resources provided by the Ministry of Defence.

- Veterans UK operates a helpline and email service for more personalized inquiries.

Factors Affecting Pension Amount

Every member of the armed forces is automatically enrolled in the Armed Forces Pension Scheme, where, uniquely among public retirement fund schemes, they contribute 0% of their monthly earnings. This scheme is unfunded and is financed directly from public funds.

Given the complexity and variation in individual circumstances, calculating an exact retirement fund amount requires specific personal and career details. These are the main factors that define the retirement fund amount:

- Service Length: Longer service generally results in a higher retirement fund.

- Rank: Higher ranks receive higher retirement funds due to higher salaries.

- Pension Scheme: Each scheme calculates retirement funds differently, affecting the final amount.

- Commuted Pension for Lump Sum: Opting to take a lump sum on retirement reduces the monthly retirement fund.

British Army Pension Schemes

A British Army retirement fund varies widely depending on factors like the individual’s rank, length of service, and the retirement fund scheme they’re part of. The British Armed Forces have introduced several retirement fund schemes over the years, notably the Armed Forces Scheme 1975 (AFPS 75), Armed Forces Scheme 2005 (AFPS 05), and the Armed Forces Scheme 2015 (AFPS 15), each with unique benefits and retirement age requirements.

AFPS 75

Under AFPS 75, service members can retire with a full retirement fund after 22 years of service if they are in other ranks, or after 16 years if they are officers. It is a portion of their final salary, and they also receive a tax-free lump sum.

The retirement age for receiving this retirement fund without reduction is 55. AFPS 75 uniquely allows early retirement fund payment for those injured in service, ensuring financial support is provided when it’s most needed.

AFPS 05

Introduced to replace AFPS 75, AFPS 05 changes the basis of the retirement fund calculation from the final salary to a career average earnings model, aiming for a more equitable system across all ranks. The normal pension age in this scheme is 65, and it also introduced a revaluation of members’ earnings to better reflect career progression.

AFPS 05 offers the option of early departure payments for members who have served a minimum of 18 years and are at least 40 years old, providing greater flexibility in retirement planning.

AFPS 15

The latest scheme, AFPS 15, further adjusts the retirement fund model to a career average revalued earnings (CARE) system, with the normal retirement fund age linked to the State Pension age, which means it will rise as the State Pension age increases.

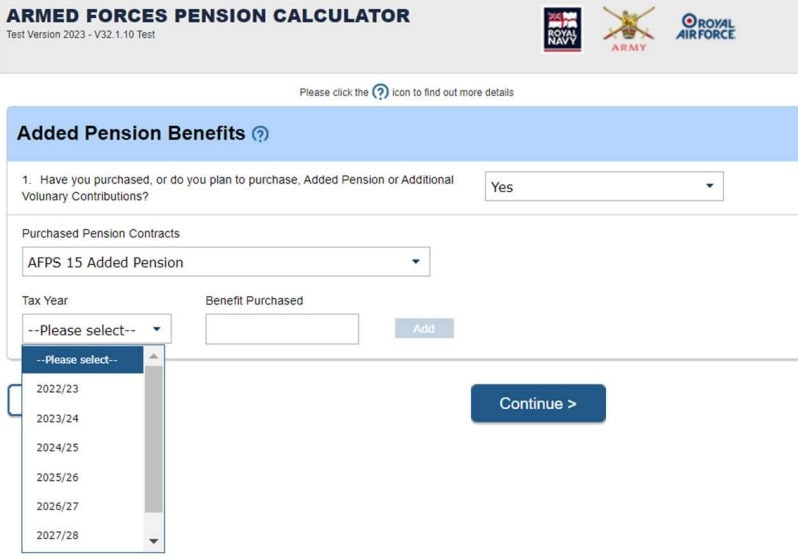

Its accrual rate is 1/47th of pensionable earnings each year, and unlike its predecessors, it does not offer an automatic lump sum, although members can opt to exchange a portion of their retirement fund for a lump sum upon retirement.

Calculate your British Army Pension

There are several online resources where you can calculate the amount of your retirement fund.

Official Ministry of Defence Resources

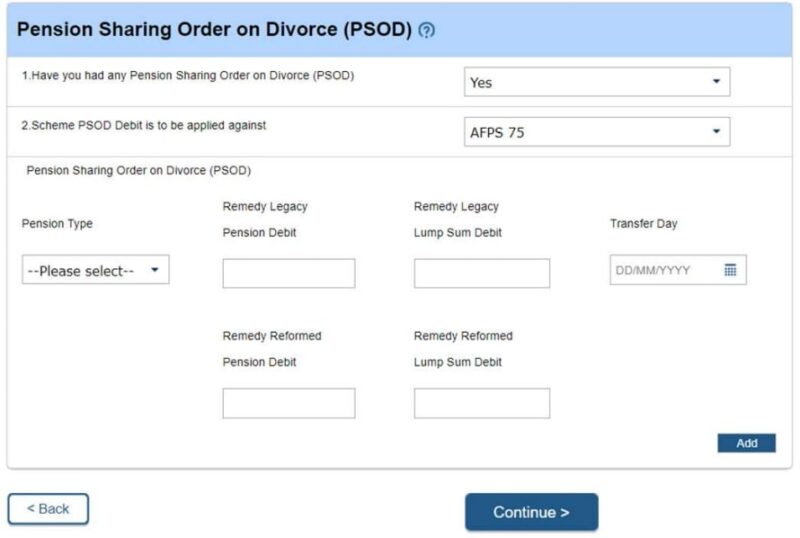

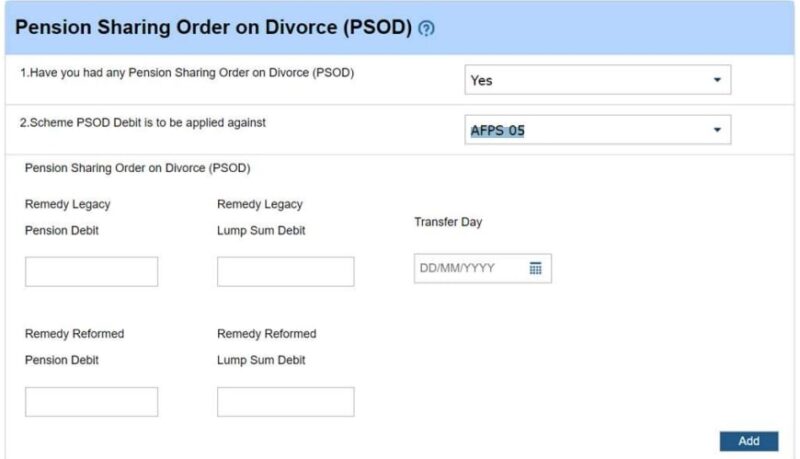

- Armed Forces Pension Calculator: The Ministry of Defence (MoD) offers an official retirement fund calculator designed to give service members an estimate of their retirement fund entitlements under various schemes. This tool requires you to input details such as your service start and end dates, rank, and salary.

- Website: Access directly to this tool through the official Gov.UK website or the Defence Gateway, where you can log in using your service credentials.

Veterans UK

- Veterans UK: Offers comprehensive support and advice on Armed Forces retirement funds, including how to apply for your retirement fund and what to expect. They can also provide specific guidance on issues like retirement fund sharing on divorce and how to claim injury or disability benefits related to service.

- Helpline and Email Support: Veterans UK operates a helpline and email service for more personalized inquiries.

Seeking Personalized Financial Advice

While tools and calculators offer a helpful starting point, they can’t fully capture the complexities of individual financial situations or future planning needs.

The Importance of Financial Advisors

Engaging a financial advisor for personalized planning is a strategic move for anyone looking to secure their financial future post-retirement. These professionals are equipped to offer bespoke advice that encompasses your entire financial landscape.

This includes not only your retirement fund but also any additional savings and investments you may have, as well as your specific retirement aspirations. A significant part of their expertise lies in elucidating the tax ramifications associated with various retirement fund decisions, such as opting for a lump sum payment and its influence on your overall tax burden.

Financial advisors are invaluable in guiding you through the myriad investment opportunities available to augment your retirement savings beyond the basic retirement fund. Their recommendations are aimed at crafting a robust retirement plan that ensures a stable and secure financial future, effectively bridging the gap between your current financial status and your retirement goals.

How to Find a Financial Advisor

When seeking financial advice, especially regarding military retirement funds, prioritizing Chartered Financial Planners is a wise strategy. These professionals are not only recognized for their high level of expertise in financial planning but also adhere to stringent ethical standards, ensuring that your financial well-being is in capable hands.

Their designation signifies a comprehensive understanding of various financial domains, including the intricacies of military retirement funds. Some financial advisors go a step further to obtain specific accreditation from the Armed Forces Pension Scheme (AFPS), highlighting their specialized knowledge and deep commitment to assisting military personnel.

Engaging with an AFPS-accredited advisor guarantees you are consulting someone intimately familiar with the nuances of military retirement fund schemes, ensuring tailored and informed advice that aligns with your unique circumstances and goals.

Additional Considerations

An advantage when considering financial advisory services is the provision of a free initial consultation offered by many advisors. This no-obligation meeting serves as an invaluable opportunity for you to gauge the scope and quality of the services on offer, without any financial commitment.

It’s a moment to ask questions, clarify expectations, and understand the advisor’s approach to managing your finances. This clarity ensures you are fully informed about the costs associated with their expertise and the extent of ongoing support you can expect. Such upfront transparency helps in making an informed decision about engaging a financial advisor to navigate the complexities of retirement planning and investment strategies.

FAQs

Can Veterans UK help me with my retirement fund queries?

Yes, Veterans UK offers a helpline and email service for personalized retirement fund inquiries and support.

Should I consult a financial advisor for my military pension?

Consulting a financial advisor is recommended for personalized retirement planning and understanding the full scope of your retirement fund benefits.

Are there financial advisors specialized in military pensions?

Yes, some financial advisors specialize in military retirement funds, with some specifically accredited by the Armed Forces Pension Scheme (AFPS).

How does my rank and length of service affect my pension?

Your rank and length of service directly influence your retirement fund amount under all British Army pension schemes (AFPS 75, AFPS 05, AFPS 15).

Conclusion

Calculating your British Army pension is a crucial step towards ensuring financial stability and security for service members and their families. Utilizing the official Armed Forces retirement fund Calculator or the Defence Gateway provides an essential resource for estimating fund benefits.

The support and personalized advice available from Veterans UK further assist in navigating the complexities of military pensions. Consulting with a financial advisor, especially those with expertise in military retirement funds, is highly recommended to tailor retirement planning to individual needs and maximize the benefits available.